Recent Why SERVPRO Posts

5 Ways the Right Restoration Company Eases the Claim Process

8/27/2022 (Permalink)

24/7 Storm Response

24/7 Storm Response

Five Reasons SERVPRO Hits the Mark

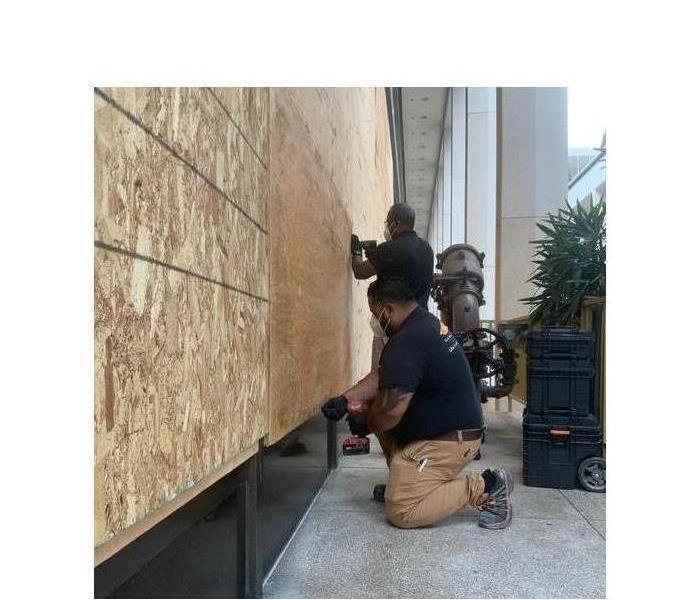

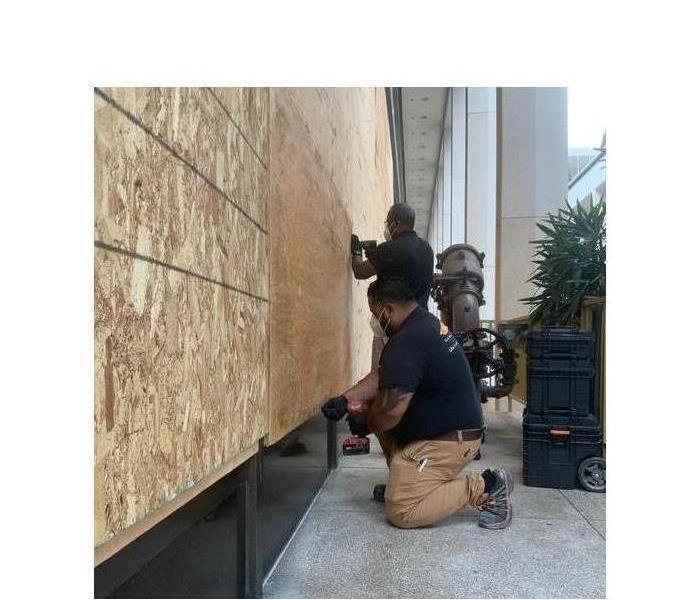

After a severe storm hits Chollas Lake, CA, there is a good chance that insurance adjusters will have a massive workload. Knowing how important quality yet quick storm restoration is to the business affected, choosing the right storm damage restoration company is essential to ensuring an easy and fast claims process that results in restoring a property to preloss condition. Below are five reasons SERVPRO hits the mark.

1. 24/7 Storm Response: No matter what time of day or day of the week, you can count on your call being answered 24/7. Once the claim call is answered, there are more than 1,900 local franchises ready to take action and get the process rolling.

2. Corporate Network: Every franchise is backed by a corporate network. That means support at all levels, from assisting the technicians to helping answer questions regarding claims or other items.

3. Certified Local Technicians: As a nationwide brand, every franchisee must adhere to strict training standards. Every technician is required to complete ongoing training to maintain IICRC certification. That training is also focused on restoring versus replacing.

4. Electronics Claims: After the initial assessment, every detail of the damage and needed cleanup and restoration repairs will be available in electronic form. This keeps the data secure and accessible across devices for all parties involved.

5. Full-service Restoration: Instead of trying to deal with numerous contractors, you get a one-stop-shop for all a business’s flood damage needs. From the get-go, the restoration team will complete any board-up services, remove damaged items, extract water, dry out the property, clean affected areas and complete all restoration needs.

When storm restoration is needed, time is always of the essence. Instead of getting bogged down by the claim process, it is worth choosing a restoration company that provides all the services need and trained to ensure a smooth claim.

What You Need To Know About Pretesting

6/6/2022 (Permalink)

Protect your business from severe weather.

Protect your business from severe weather.

Pretesting: What You Need to Know

When your Oak Park, CA commercial property has been affected by disaster, pretesting is a crucial part of the insurance claim process. As one of the first steps that professionals take when responding to fire, smoke, or water damage, this initial testing provides vital information, including:

- The full extent of damage

- The types of damage to property, furnishings, inventory, and other belongings

- The chances of repairing or restoring affected items and areas

- The best tools and methods for cleanup and restoration

With this info at hand, property damage repair and mitigation technicians deliver accurate estimates and plans for recovery completion.

Why Your Insurance Company Values Pretesting

In addition to accessing details about the damage to your property and accurate financial estimates, your insurance agent uses the info from the pretest process to get your claim in motion. Your insurance company naturally wants the recovery process to cost as little as possible, and a quick cleanup response is crucial to a speedy recovery with minimal, if any, secondary damage.

How Initial Testing Improves Recovery Results

If, for example, this initial testing shows the cleanup and restoration professionals that there are holes in the roof or the foundation, technicians will work right away to set up temporary tarping and boarding. This ensures that further damage has been mitigated, lessened, or prevented altogether. Early testing also alerts technicians to problems that could develop. For example, water left standing in your building creates a mold risk within just a day or two.

When your Oak Park, CA, business has been affected by flooding or smoke from a neighbor's fire, pretesting is the best way to ensure that your property doesn't experience lasting damage. You'll have accurate estimates for cost and recovery, get better results from your insurance company, and prevent further unnecessary damage. SERVPRO works closely with insurance agents and understands the importance of a thorough, speedy recovery.

The Importance of Corporate Resources After a Large Disaster

4/27/2022 (Permalink)

Storm damage causes carpet damage.

Storm damage causes carpet damage.

After a Major Disaster, Corporate Resources Are Critical

Many disasters are simply local events that impact one or two companies. These situations include localized storm issues, a company fire or a broken plumbing system in a school or office. Other times, though, a disaster impacts a much wider area with many companies and homeowners suffering a catastrophic loss all at once. The California wildfires are a good example of this widespread damage, as are the recent floods of Midland, Michigan caused by a dam breach. At this time, the 1,700 SERVPRO franchises that operate across North America often pool their resources to help the wider community. This allows more people to be helped in a timely fashion.

Corporate Strength

In a major flooding event, local franchises can become overwhelmed. When hundreds of homes and businesses are instantaneously dealing with flooded properties, only so many can be helped by the franchises in San Diego, CA. By bringing in other professional restoration service franchises, the following benefits result:

- Additional equipment

- More workers

- More expertise

- Faster response times

- Reduced damages

Overall, this results in a smaller catastrophic loss for the impacted community. A multitude of crews coming together means critical issues can be addressed without delays. More specialized equipment on hand enables crews to pump out standing water, dry out flooded areas of buildings and respond to dangerous situations.

Local Knowledge

In coordination with local resources, SERVPRO's Disaster Recovery Team mobilizes as needed to help with widespread storm damage and other issues. This has been a successful model to help devastated communities recover from large-scale events for many years. Communities across North America have benefitted from this pooling of valuable resources of equipment and knowledge. Whether it is a large hurricane along the coast or major flooding in the heartland, communities can count on a robust response from professionals.

A catastrophic loss can be minimized by a coordinated response. Local knowledge and corporate strength is a potent combination for handling disasters.

You’ve Had a Commercial Fire. Now What?

3/23/2022 (Permalink)

SERVPRO walks with you through every step of the fire damage restoration process! In this photo, SERVPRO has contained kitchen fire damage.

SERVPRO walks with you through every step of the fire damage restoration process! In this photo, SERVPRO has contained kitchen fire damage.

Business owners in San Diego, CA have likely considered every possibility when it comes to their insurance policy. You don’t want to have to use it, but you want to make sure you have it. Those who are in the unfortunate position of having to use their fire insurance policy can often feel overwhelmed and unsure of where to start. Thankfully, these policies are built to take care of everything and allow you to simply write the checks and sign the documents. To have a better understanding of how the process works, however, we’ve included a few tips to help set your mind at ease.

1. Your First Call

Once you’ve determined the safety of your employees, and the fire department has handled the flames, your first call should be to your insurance company. They will often have a preferred disaster restoration professional, but many will also allow you to choose whichever company you may prefer. At any rate, the disaster professionals will handle the problem from this point forward.

2. Inspection and Board-Up

Once the fire restoration professionals have arrived on the scene, they will immediately begin the inspection process. One of the most important parts of this process will be identifying the assets and belongings that can be salvaged and those that cannot. They will also assess the severity of smoke, soot and fire damage, and designate areas for smoke cleaning. Once that’s out of the way, any destroyed windows or ceilings will be covered with boards and tarps to prevent further damage from the elements.

3. Water and Fire Damage Treatment

If the sprinklers in your commercial building caused severe water damage, it will be addressed first before the smoke and fire damage. This will include state-of-the-art equipment and techniques to remove moisture from walls and surfaces. These professionals are also trained to remove soot and smoke damage from the premises as part of the fire restoration process.

4. Finishing Touches

Once the damaged items are treated, the fire restoration professionals will clean and sanitize the salvageable items in the building and attempt to restore it to its pre-fire condition, including any necessary structural repairs.

3 Steps for Discussing Mold Damage With Your Insurance Company

3/2/2022 (Permalink)

SERVPRO brings in customized equipment to help stabilize areas affected by flooding or mold and remediate excess moisture.

SERVPRO brings in customized equipment to help stabilize areas affected by flooding or mold and remediate excess moisture.

After a flood damages your San Diego, CA business, you may not be sure which steps to take when it comes to cleanup and filing an insurance claim. Of all the damage you might encounter, one of the most puzzling can be fungus growth. No matter the amount of mold you are dealing with or where it might have taken hold on your property, knowing how to report the issue to your insurance company can help you take the necessary steps to resolve the problem.

1. Do Not Touch the Damaged Areas

Before you call the insurance company, you might want to take photos of any mold damage you find. However, it is important that you do not physically disturb these areas. If you see mold where you cannot reach it without moving tables, chairs or equipment or possibly sending spores into the air, leave it for the insurance company to photograph and provide an explanation before you move on with filing a claim.

2. Discuss Coverage Options With an Agent

Understanding your insurance company’s policies on fungus growth and what they generally cover for your business can be an important step in filing a claim. You may want to sit down with an experienced agent and go over your current policy regarding the kind of mold coverage you can receive after you file your claim.

3. Discuss Cleanup Plans

Your insurance agent may be interested in what your cleanup plans are once you file your claim. He or she may ask if you plan to use professional mold remediation services and how you plan to handle safety issues that might relate to the process. Keeping your mold insurance providers in the loop about your cleanup efforts may assist them with processing your claim faster.

Dealing with fungus growth in your San Diego, CA business after water damage can be frustrating. However, working closely with your insurance company can help get your business up and running again with a minimum amount of hassle.

24/7 Emergency Service

24/7 Emergency Service